Invoicing

Invoices can be generated for employers based on the employer contributions in paid learner allowances. If you do not pay learner allowances but wish to invoice an employer for miscellaneous fees, please see Employer Invoicing (General).

Generating Employer Invoices

Before generating employer invoices, you must first have processed and finalised the pay runs for the weeks to be invoiced (see Running Allowances).

To generate employer invoices:

- Go to Management on the toolbar and select Payments | Invoice Runs.

- Click the

button.

button. - Enter the following details for the invoice run:

- Run number – This is auto-generated, but can be altered to a more meaningful alphanumeric format if required.

- Period end date – This is the last day of the week for which invoices are to be calculated.

- Invoice date – The date recorded against the invoice.

- Run Centre Type - This lets you choose whether to run only for learners at the user’s centre, only for employers at the user’s centre, or for all centres.

- Processing Mode – There are three options:

- Stop on all invoices – This will halt the invoice run on each invoice for editing and confirmation.

- Stop on all invoice details – This will halt on each allowance item requiring an invoice.

- Do not stop at all – This will perform the invoice run without halting on any invoices.

- User Run for Invoices as well – This will create a pay run row based on the invoices. Please note that the pay run must be re-run to generate the payments.

-

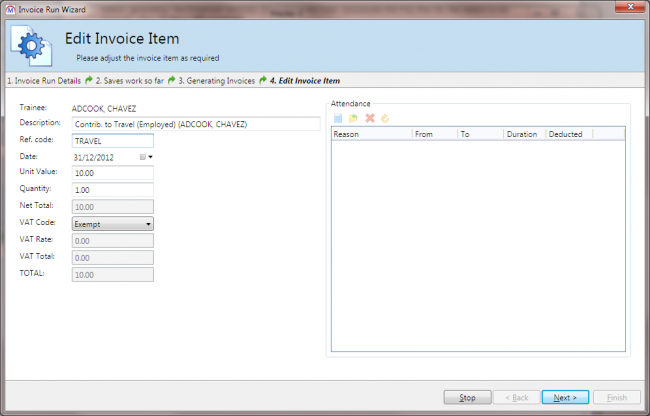

Click Next. If you chose the Stop on all invoice details option, the run will halt on each allowance item in the invoices.

The item details can be amended as required here. Any un-deducted attendance records for the invoice run period will be displayed on the right. Attendance records can be added or edited using the

and

and  buttons respectively.

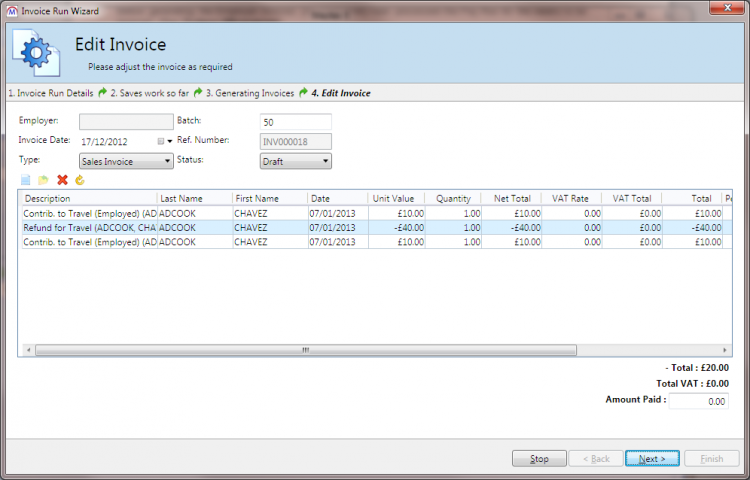

buttons respectively.If you chose the Stop on all invoices option, the run will halt on each invoice in the run. The Edit Invoice screen shows the relevant allowance items in a grid.

Individual allowance items can be edited by selecting the row and clicking the

button. You can also add new invoice items by clicking the

button. You can also add new invoice items by clicking the  button.

button.The Type dropdown box allows you to select the type of invoice.

- Once all invoices / items have been configured as required, click Finish.

Once the invoice run has completed, it can be viewed as follows:

- Select the invoice run in the top table and click the

button to load it.

button to load it. - The invoices from the invoice run will be listed in the bottom table. Select an invoice and click Edit.

- The invoice can now be amended as required.

Employer Invoicing (General)

General employer invoicing refers to the creation of invoices not linked to learner allowances. This method of invoicing processes each learner who can be invoiced and is attached to an employer, calculating the number of days / weeks at a specified rate.

Setting up Invoice Rates

Invoice rates can be configured for individual learner placements. To do this:

- Open a learner record.

- On the Summary tab, select an employer from the Employer / Personnel grid and click Edit.

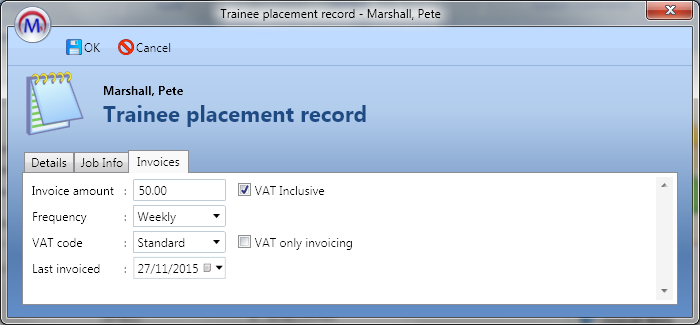

- Go to the Invoices tab and enter the following details:

- Invoice amount – The amount to be paid each day / week.

- VAT Inclusive – Tick this box if the VAT is included in the entered amount.

- Frequency – How often the amount is paid (daily, weekly, once or never).

- VAT code – Choose the applicable VAT rate.

- VAT only invoicing – Tick this box if you are only invoicing for the VAT.

- Last invoiced – This date will be automatically completed when the first invoice run is processed. If you do not want the invoice to generate back to the learner’s start date with the employer, this date should be set to the previous month’s end date or the day before you want to start invoicing.

- Click OK.

The placement invoice will now be included on invoice runs.

Please note that the system will continue to generate invoices for the learner’s employer until either the End date for the placement is entered or the Frequency is set to Never.

Creating Individual Employer Invoices

Invoices can be created for individual employers with no automatic association with learners or allowance payments.

To create an individual employer invoice:

- Open an employer record and go to the Invoices tab.

- Any existing invoices for the employer will be displayed here. Click the

button to create a new invoice.

button to create a new invoice. - Configure the Invoice date, Type and Batch number as required.

- Click the

button to add an invoice item.

button to add an invoice item. - Enter the following details:

- Trainee – If you wish to associate the item with a learner, search for and select the learner by clicking the

button.

button. - Description – Enter a description of the invoice item.

- Ref. code – Enter a reference code if required.

- Date – This is the date the item applies to.

- Unit Value – The cost of the item.

- Quantity – The number of items. This will update the net total (i.e. unit value x quantity).

- VAT Code – The VAT code to use.

- Trainee – If you wish to associate the item with a learner, search for and select the learner by clicking the

- Click OK.

- Add additional items as required.

- Click OK when the invoice is complete.

- Click Apply to save the changes.

Quarterly Employer Invoicing

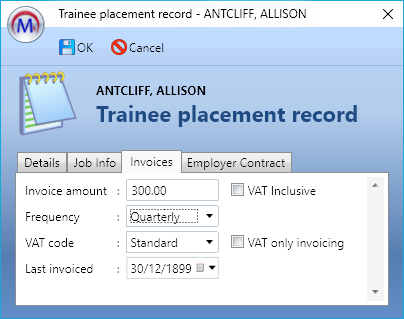

Employer placement invoicing can be done on a quarterly basis. Note that this requires the Allowances and Payments module.

- Open a learner record and go to the Summary tab.

- On the Employer / Personnel grid, select an employer and click Edit.

- Go to the Invoices tab.

- The Frequency box now includes an option for Quarterly.

- Amend other values as required and click OK, then click Apply.

Note that fractional quarters are not calculated – i.e. the full amount per period will be invoiced.